Though it gets less publicity these days than it did in years past, the foreclosure crisis in the U.S. lingers. Sometimes it isn’t even the homeowners who suffer most from foreclosure. Approximately 40% of the time, according to some estimates, it is tenants who wind up holding the bag. And that is certainly true in the case of Pam Ragland, who lives in California’s Orange County.

Ragland–now an experienced anti-foreclosure activist–was a victim of wrongful foreclosure at the hands of U.S. Bank, and had to leave her longtime home as a result. Thrust into being a renter after 34 years of owning homes — she eventually got tired of moving her kids every year or two. Ragland found a place to rent, and negotiated a long-term lease while fighting her lawsuit against US Bank. Ragland describes her experience like this:

“My home was foreclosed on a week before Christmas in 2008–despite a stay and active lawsuit. My kids (then 6 and 7–one Autistic) and I were ultimately evicted from our home of 19 years—and in 2009 I was forced into being a renter. I persisted, and won a precedent setting appeal against US Bank in 2012–who finally settled after 6 years and a trial in 2014. In 2014–while still fighting US Bank– wanting stability for my kids, I leased a house for five years. My kids—then 11 and 12–were FINALLY happy. That is–until Wells Fargo foreclosed on my rental just 3 months into our lease. Instead of honoring my lease as the law requires–Wells Fargo immediately tried to evict my family TWICE over the next four years.”

Ragland questioned the legality of the foreclosure, as she was well aware of the reputation of both Wells Fargo and its servicer Ocwen as companies who tend to play fast and loose with foreclosure law. In fact–Wells Fargo recently admitted that it had wrongfully foreclosed on some homes:

“Wells Fargo has admitted a ‘calculation error’ may have led to as many as 400 struggling homeowners needlessly losing their homes to foreclosure. The mistake in a mortgage-modification tool, discovered nearly three years ago, wrongly factored lawyers’ fees into the formula put forth by the government to determine if a homeowner would qualify for a federally backed program, like 2009’s Home Affordable Modification Program, or HAMP, Wells Fargo revealed in a regulatory filing. As a result of the bank’s error, as many as 625 customers were ‘incorrectly denied a loan modification,’ Wells said — with 400 then having their homes foreclosed upon.”

Ragland believes that number is grossly under estimated. In her case involving her rental, Ragland discovered the recorded documents giving the loan to Wells Fargo were actually produced at a what basically amounts to an apparent forgery center called “DocX” using a well-known false name “Linda Green, Vice President.” (NOTE: In 2013, DocX founder Lorraine Brown was sentenced to 5 years in prison for the forgery of over 1 million mortgage-related documents.)

According to Ragland, Wells Fargo never owned the loan, and had no right to foreclose. Not only that, Wells Fargo was bound by law to honor her lease, instead of immediately trying to evict her family. Indeed, California’s AB 2610 was in effect at the time of the foreclosure sale of Ragland’s rental (as was the federal Protecting Tenants at Foreclosure Act, which has now been made permanent), and that law states the following:

“In addition to the rights set forth in subdivision (a), tenants or subtenants holding possession of a rental housing unit under a fixed-term residential lease entered into before transfer of title at the foreclosure sale shall have the right to possession until the end of the lease term, and all rights and obligations under the lease shall survive foreclosure…”

She eventually discovered in depositions that neither Wells nor Ocwen even have a process to verify the validity of her lease—regardless of why they foreclosed.

It seems clear Wells Fargo just automatically evicts renters, regardless of their right to live out their lease. “Most renters could not fight them like I have,” observed Ragland. “It’s just wrong for families to be illegally uprooted.”

Now what?

The problem for Ragland is that she now lives in and rents a house that, for all practical purposes, is owned by an entity that is in effect, a slumlord. Although the house has issues, and Ragland’s lease contained provisions for making specific repairs as a condition of the lease, there is no landlord to whom Ragland can turn to work out anything with. Major repairs, maintenance, and habitability issues have all fallen to Ragland. To date she has been forced to spend thousands upon thousands of dollars not only in legal fees–but also in repairs to the property.

Although the house was foreclosed on by Wells Fargo, Ragland defeated their continued attempts to evict her. This of course means not only that the former owner of Ragland’s rental no longer legally owns the house, but now Wells Fargo has, according to Ragland, continually washed its hands of any landlord responsibilities at the property:

“I have spent nearly $100K in attorney’s fees to defeat Wells Fargo’s illegal evictions, and 6 figures plus to fix the house. It is ridiculous. They have refused to be the landlord, refused to fix what the lease obligates them to fix–and left me to do it all. They did not tell me where to pay rent. I thought they would try to say I’m a deadbeat, like they do with homeowners. So, I started taking the rent and diverting it to the repairs. Then I soon had to spend $8K on the rat infestation… $5K on mold…$8K on electrical issues — and it just went like that. Pretty soon I had paid more than the entire 5 year lease in less than 2 years in just repairs. Of course I had no idea they would break the law like this and here we would be, more than 4 years later with them still refusing to repay me or take responsibility. Duh – it’s Wells Fargo!!!”

So much for providing peace and stability for Ragland’s kids—the purpose of the lease in the first place. On top of all that, the property has many issues, and despite what Ragland has spent on repairs, experts have said her family is still in danger. Here are relevant pages in a couple reports from an engineering firm that inspected the property:

Besides the list the former owner agreed to repair (and which Wells Fargo ignored despite being a legal part of the lease) there are the geological and structural issues. Wells Fargo has been given expert reports, and their attorneys even inspected the house, telling her “We don’t know how they got a loan on this house.” Still Wells Fargo has done nothing to help Ragland’s family–they just assigned a new attorney instead. Ragland still cannot keep the rats out either, as structural repairs are needed. Recently, Ragland said her son had to use a BB gun to kill a rat running around the living room in broad daylight.

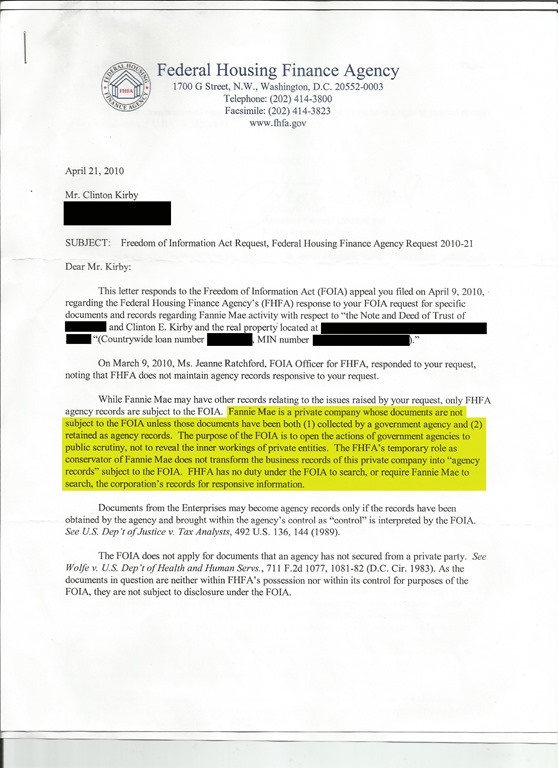

Wells Fargo’s response to all of this? They told Ragland that she has no “relationship” with either Wells or Ocwen. See the highlighted text in this letter:

Even with attorneys, Ragland cannot get Wells Fargo to make needed repairs. Worse, Ragland has tried repeatedly to get Wells Fargo to pay her back what they now owe her for their illegal eviction attempts, and repairs to what they claim is “their” house. Wells Fargo has repeatedly ignored Ragland. “I guess the only thing left is for me to sue them for fraud”, Ragland explained. That is an area she knows well, after her six year battle for fraud against US Bank. However, after already spending six years fighting US Bank, and another four so far fighting Wells Fargo, Ragland is not anxious to put her kids through yet another bank legal battle. “Why should my kids have to spend their entire lives fighting banks?” Ragland stated. “Still, that is a lot of money for me to walk away from. It’s just wrong. When will this fraudulent activity by banks stop?” she asked. “Even though Wells Fargo has repeatedly been investigated, they seem to continue to do whatever they want.”